Maximize Member Lifetime Value Through Intent Driven Engagement

Turn every interaction into profitable loyalty by acting on real-time member intent.

Rise In Operational Efficiency

Reduction In Service Request Time

Reduction In Total Cost Of Ownership

Efficiency In Transactional

Processes

Driving Credit Union Growth: The VARTA Advantage

Member communications governed by regulation to power share, lending, and wallet growth responsibly

Deposit

Growth

Anticipates member intent by analyzing surplus liquidity and money inflows to trigger contextual offers for CDs, savings sweeps, or investments in the moment.

Member Loan

Growth

Goes beyond static credit scores by using Behavioral Intelligence to detect real-time intent (spending shifts, life events) and instantly push the next-best, right-fit loan offer that helps the member.

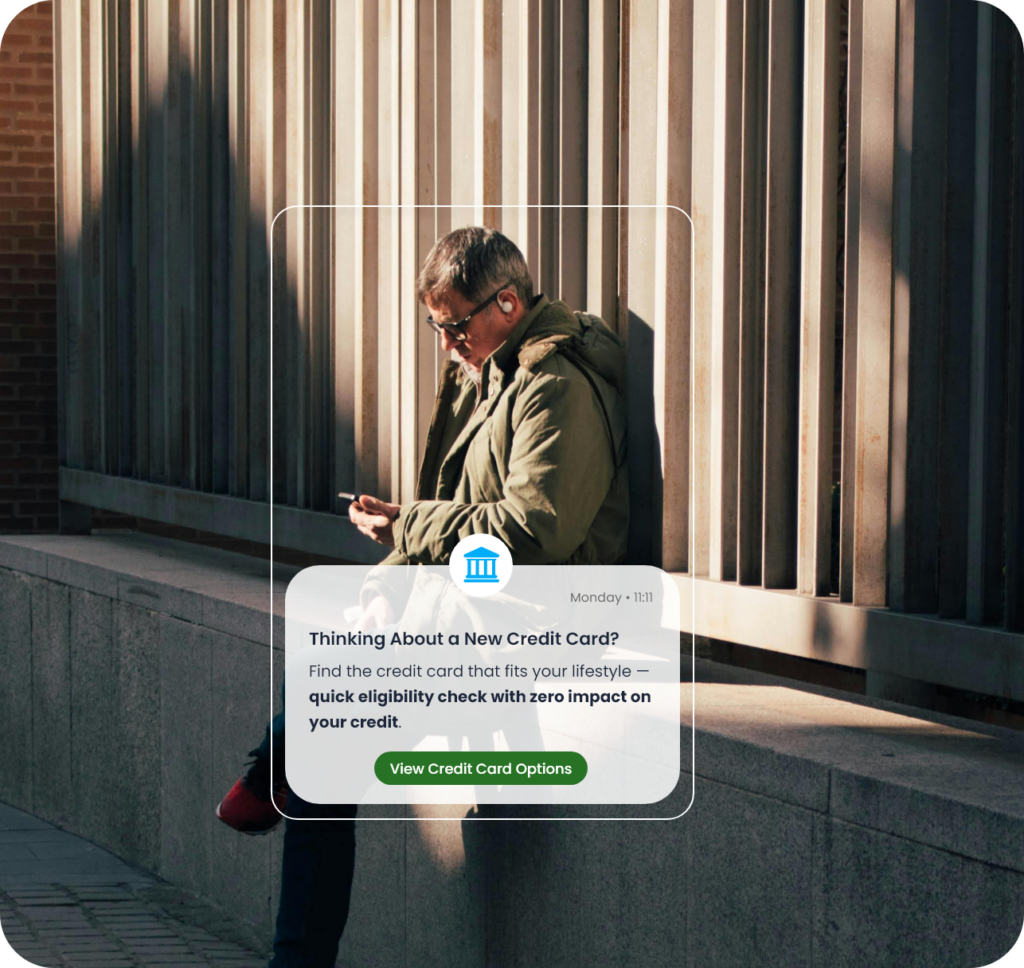

Card Spend &

Wallet Share

Drives member loyalty and wallet-share growth with contextual nudges delivered immediately following low-spend periods or category-specific transactions.

Community

Cross-sell

Identifies adjacent member needs based on financial behavior to compliantly cross-sell internal or partner products within transactional messages, keeping the member relationship central.

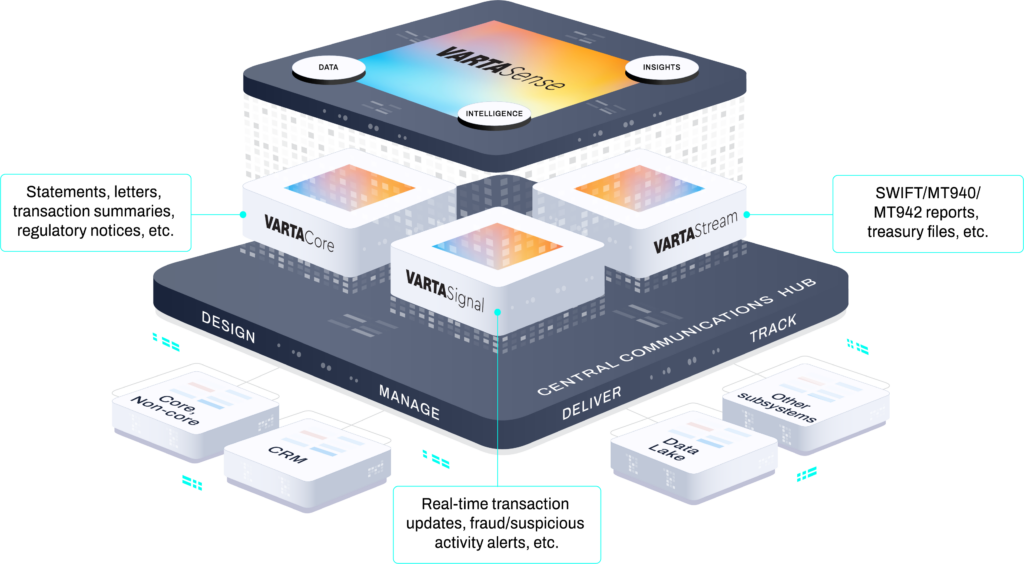

VARTA: Unified Intelligence for Member Trust and Growth

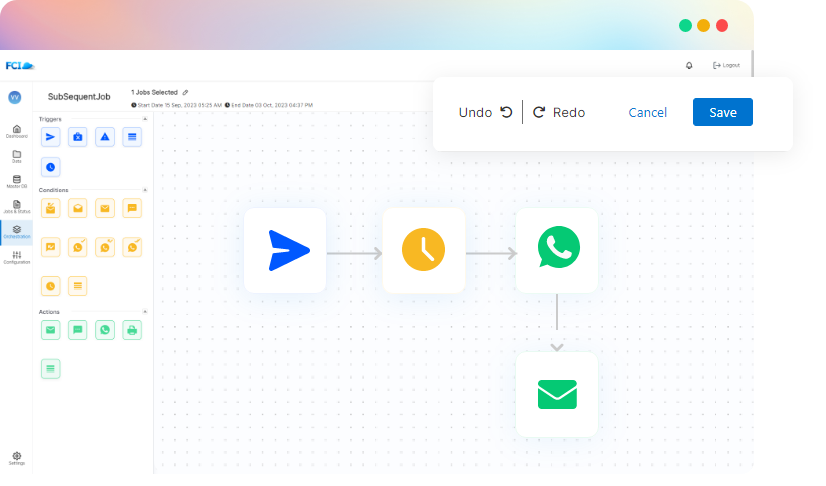

Transform fragmented communication into a single Central Communication Hub.Convert real-time signals into orchestrated trust, compliance, and measurable Member Lifetime Value (LTV)

Unify all transactional, behavioral, and attitudinal data by integrating seamlessly with your Core Processing System. This establishes a single source of member truth, ensuring Lending, Service, and Marketing teams operate from a complete, consistent history.

Detect real-time member intent beyond static segmentation. Context-Awareness flags immediate financial shifts—such as low balance or cash surplus—to proactively deliver a fee-avoidance strategy or optimal savings guidance, reinforcing member trust.

Secure full Wallet Share by adapting one-to-one member journeys to real-time intent. Every touchpoint is hyper-relevant, driving measurable cross-sell and maximizing Member Lifetime Value.

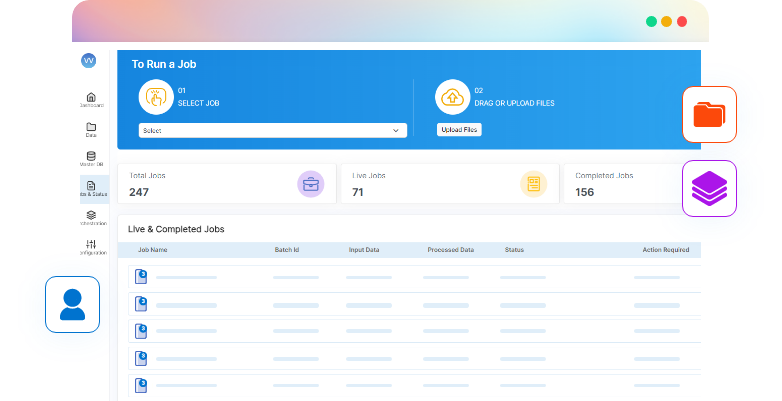

Streamline compliance and risk governance. Center all growth nudges, mandatory disclosures, and risk alerts in one platform. This single-source control eliminates vendor sprawl and ensures an instant, auditable trail for every member interaction.

Explore more

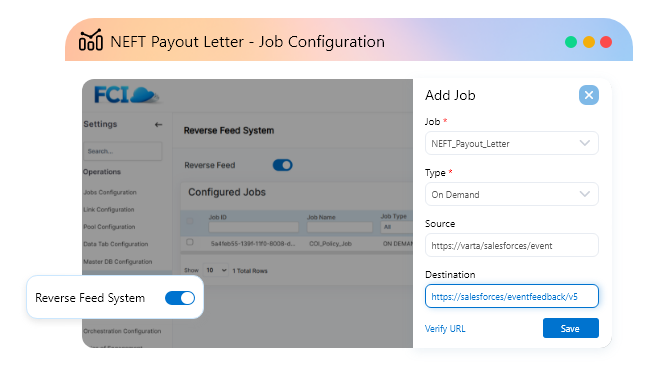

Regulated Message Delivery with Full Oversight

Critical alerts like OTPs, fraud flags, and payment reminders require certainty and proof. VARTA ensures instant delivery through consent approved channels with a unified regulatory control and review trail

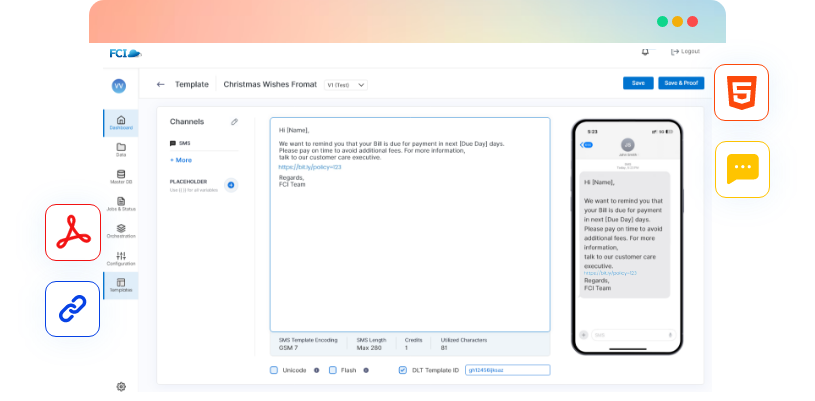

Standardize messaging templates, content workflows, routing logic, and compliance rules in one governed layer. Remove duplicate tools, reduce manual work, and ensure every message is consistent across units.

Guarantee time-critical messages reach the customer instantly. Maintain audit trails, enforce permissions, and keep operational risk in check. Build reliability across revenue, service, and compliance functions.

Capture live transactional signals that reflect revenue risk, fraud events, payment behavior, and responsiveness. Build real-time awareness needed to act with confidence.

brochure

Activating Member Communication to Achieve Credit Union Growth

Credit unions are facing a growth paradox. Member trust remains strong, yet product penetration, deposit growth, and lending expansion continue to lag behind expectations.

Orchestrating Communications For Revenue, Risk, And Compliance

Ensure excellence across all critical banking functions by unifying control over the entire communication lifecycle

VARTACore

Documents, letters, and statements delivered through a unified, compliant framework.

Single governed communication and data layer.

Centralized templates, workflows, and compliance controls.

Consistent, scalable communication across all business units.

VARTASignal

Real-time transactional notifications, OTPs, and alerts that keep customers informed and engaged via SMS, email, WhatsApp, and push notifications.

Instant transaction and balance alerts.

Payment reminders and due-date nudges.

Prevent fraud with proactive event-based messaging.

VARTAStream

Intelligent, no-code communication flows for precise, high-speed business and commercial banking statement delivery.

Enriched EOD and intra-day statements.

Multi-format, ERP-compatible, ISO 20022-ready statements.

Automate omni-channel distribution without middleware, streamlining operations.

VARTASense

Real-time, AI-driven contextual and behavioral insights that guide every next-best action.

Understand customer intent before they express it.

Recommend product offers aligned to financial goals and life moments.

Power hyper-personalized journeys that increase conversion and loyalty.

VARTACore

Documents, letters, and statements delivered through a unified, compliant framework.

Single governed communication and data layer.

Centralized templates, workflows, and compliance controls.

Consistent, scalable communication across all business units.

VARTASignal

Real-time transactional notifications, OTPs, and alerts that keep customers informed and engaged via SMS, email, WhatsApp, and push notifications.

Instant transaction and balance alerts.

Payment reminders and due-date nudges.

Prevent fraud with proactive event-based

messaging.

VARTAStream

Intelligent, no-code communication flows for precise, high-speed business and commercial banking statement delivery.

Enriched EOD and intra-day statements.

Multi-format, ERP-compatible, ISO 20022-ready statements.

Automate omni-channel distribution without

middleware, streamlining operations.

VARTASense

Real-time, AI-driven contextual and behavioral insights that guide every next-best action.

Understand customer intent before they express it.

Recommend product offers aligned to financial

goals and life moments.

Power hyper-personalized journeys that

increase conversion and loyalty.

VARTA Solution Suite

Shape Better Customer Journeys With One Integrated, Outcome-Focused Engagement Layer

Wondering how it’ll work for you?

VARTA Seamlessly Works With Your Existing Stack

Maximize the value of your tech investments by capturing signals and automating action

Core Banking Systems

VARTA integrates directly with your CBS to capture real-time transactional signals—so you can act instantly on deposits, loans, and payments.

Explore more

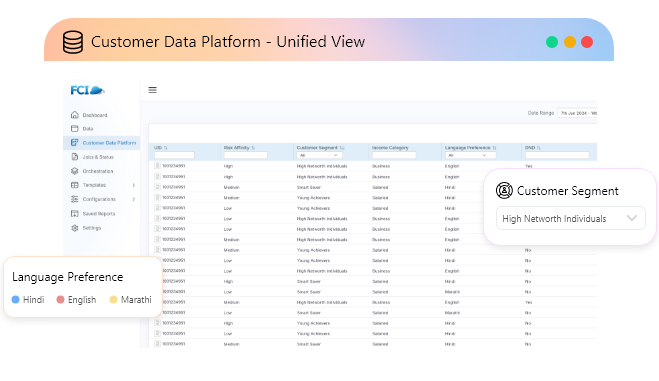

Customer Data Platform

Experience versatile interactivity with Varta’s command centre that streamlines communication of the customer according to the preferred channel.

Explore more

Customer Relationship Management

Supercharge your CRM with actionable intelligence. VARTA prioritizes leads, recommends next-best actions, and empowers RMs to engage at the right moment.

Explore more

Unified Engagement Layer

VARTA unifies fragmented stacks into a single engagement layer bridging:

- MarTech

- CPaaS

- CCM and compliance tools

Explore more

VARTA Seamlessly Works With Your Existing Stack

Maximize the value of your tech investments by capturing signals and automating actions.

Core Banking Systems

VARTA integrates directly with your CBS to capture real-time transactional signals—so you can act instantly on deposits, loans, and payments.

Explore more

- Solution brief: VARTA Extends the Power of Core Banking Systems

Customer Data Platform

Experience versatile interactivity with Varta’s command centre that streamlines communication of the customer according to the preferred channel.

Explore more

- Why CDPs Alone Can’t Drive Banking Growth

Customer Relationship Management

Supercharge your CRM with actionable intelligence. VARTA prioritizes leads, recommends next-best actions, and empowers RMs to engage at the right moment.

Explore more

- Boosting RM Productivity with VARTA + CRM

Unified Engagement Layer

VARTA unifies fragmented stacks into a single engagement layer—bridging martech, CPaaS, CCM, and compliance tools.

Explore more

- Simplify Your Stack: Why Banks Don’t Need 4 Different Platforms to Drive Growth

Don't Just Take Our Word For It

Banking

Banking

Insurance

Insurance

Credit Unions

Credit Unions

Professional Services

Professional Services

Consulting & Advisory

Consulting & Advisory

Legacy Migration

Legacy Migration

Insights

Insights

Whitepapers

Whitepapers

FAQs

FAQs

Brochures

Brochures

E-Books

E-Books

Glossary

Glossary

Case Studies

Case Studies

Events & News

Events & News

About Us

About Us

Information Security

Information Security

FCI Cares

FCI Cares

Leadership

Leadership

Careers

Careers

Partner Program

Partner Program

Current Openings

Current Openings Unify Data

Unify Data Detect Intent for Proactive Financial Nudges

Detect Intent for Proactive Financial Nudges Secure Full Wallet Share with Hyper-Relevance

Secure Full Wallet Share with Hyper-Relevance Streamline engagement with compliance

Streamline engagement with compliance