As customers interact with various industries and experience seamless, convenient, and personalized services in their daily lives, their expectations naturally extend to the insurance sector. They no longer differentiate between their insurance provider and other service-oriented businesses; they expect the same level of accessibility, responsiveness, and individualized attention from their insurers. In essence, customers have raised the bar for what they consider acceptable in the insurance industry.

To meet these evolving and heightened demands, insurance companies are required to embrace a powerful tool: the omnichannel communication strategy. This approach to communication is not just an option or a nice-to-have feature; it has become an absolute necessity for insurers looking to not only meet customer expectations but also exceed them.

This strategy revolves around the concept of providing a seamless and consistent communication experience to customers across various channels, such as phone calls, emails, chat, text messages, and even social media. The central focus is on creating a unified and integrated approach to customer interaction that transcends individual communication channels.

Customers no longer have to endure the frustration of being passed between departments or experiencing inconsistent service when they switch from one communication channel to another. With an omnichannel communication strategy in place, insurers can ensure that the customer’s journey is smooth and coherent, regardless of the channel they choose to use.

The ever-rising customer expectations in the insurance industry have necessitated a shift towards an exceptional communication strategy. Omnichannel Communication Strategy is not just a trend; it’s a fundamental shift in how insurers engage with their policyholders. By adopting this approach, insurance companies can enhance the customer experience, drive satisfaction, and ultimately thrive in a fiercely competitive market.

Shifting Customer Expectations in the Insurance Industry

Traditionally, the insurance industry has been characterized by its conventional and paperwork-heavy operations. It was an industry where policies, claims, and customer interactions primarily revolved around physical documents, face-to-face meetings, and phone calls. However, in recent years, a significant and disruptive transformation has been underway – a digital revolution that is redefining how insurance companies operate and serve their customers.

The primary catalyst for this transformation can be traced back to the ever-increasing expectations of customers. In today’s fast-paced, technology-driven world, customers have grown accustomed to the immediacy of information and tailored experiences. They can order products online and have them delivered within hours. They can customize their entertainment choices and have personalized recommendations served to them. This digital convenience and personalization have permeated nearly every aspect of their lives.

Given these experiences, it’s only natural that insurance policyholders now expect the same level of accessibility, responsiveness, and personalization from their insurance providers. They no longer have patience for the lengthy, paper-based processes and time-consuming interactions that were once the norm in the insurance industry. Instead, they demand insurance services that meet them where they are, when they need it, and in ways that suit their preferences.

The core of this customer-driven transformation lies in the need for more accessible and responsive interactions. Customers want to be able to reach their insurance providers quickly, get information promptly, and have their unique needs addressed efficiently. Whether it’s filing a claim, seeking assistance, or simply having questions answered, policyholders expect a level of service that mirrors the seamless experiences they encounter in their interactions with other digital services.

This shift in customer expectations has significant implications for the insurance industry. Companies that are quick to recognize and adapt to these changing dynamics are better positioned to thrive in this new landscape. Embracing digital transformation and adopting customer-centric omnichannel communication strategy, is essential for insurers looking to meet the evolving demands of their policyholders. It is in this context that the importance of omnichannel communication in the insurance industry becomes not just a strategic choice but a necessity to stay relevant and competitive.”

The Insurance Customer Experience Evolution

In the ever-evolving landscape of the insurance industry, a significant shift has occurred in the way insurance companies interact with their customers. This transformation is most notably seen in the growing emphasis on what is now referred to as “insurance customer experience.” The term, once confined to the background of the insurance business, has now taken center stage and plays a pivotal role in customer retention and loyalty.

Historically, the insurance industry was often associated with lengthy processes, intricate paperwork, and, in the eyes of many customers, a lack of responsiveness. Policyholders would endure long waiting times, complicated claims procedures, and inconsistent service when communicating with their insurance providers. However, as we transition into an era defined by instant access to information and personalized experiences, these traditional aspects of insurance are no longer acceptable to customers.

Modern policyholders have grown accustomed to the seamless, hassle-free interactions they experience with other service providers, whether it’s ordering a product online, hailing a ride with a ridesharing app, or even accessing their bank accounts. They expect similar levels of convenience and efficiency from their insurance companies. This change in customer expectations is where the importance of an omnichannel communication strategy becomes paramount.

Omnichannel Communication Strategy in Insurance

In the context of insurance, an omnichannel communication strategy refers to the ability of insurers to engage with their customers consistently across various communication channels. These channels might include phone calls, emails, chat, text messages, or even social media. Regardless of the channel used, customers should receive a uniform and coherent experience.

1. Streamlining Claims Processing

Streamlining claims processing is a crucial aspect of the insurance industry because it directly impacts the overall customer experience. When customers need to file a claim, it typically means they’ve experienced an unfortunate event, such as an accident, damage, or loss. This can be a highly stressful and challenging time for them, and their expectations for a smooth claims process are understandably high.

An omnichannel communication strategy in claims processing refers to the insurance company’s ability to handle and manage claims seamlessly across various communication channels, including but not limited to phone calls, emails, chat, text messages, and even social media. Here’s a more detailed breakdown of why this is significant:

- Efficiency: Filing an insurance claim can be a complex process involving documentation, assessment, and communication with the insurance company. An omnichannel approach ensures that this process is streamlined, reducing unnecessary delays and paperwork. Claims adjusters and representatives can access information from multiple channels, enabling them to process claims more efficiently.

- Customer Choice: Different customers have different preferences for how they want to interact with their insurance company, especially during the stressful claims process. Some may prefer speaking to a claims adjuster over the phone, while others may want to communicate through email or text messages. An omnichannel communication strategy allows customers to choose their preferred communication channel, making the process more convenient and less stressful for them.

- Real-time Updates: During the claims process, customers are often anxious to know the status of their claims. An omnichannel approach enables the insurance company to provide real-time updates to customers through their chosen channel. This not only keeps customers informed but also reduces the need for them to repeatedly contact the insurer for updates.

- Transparency: When customers can inquire about their claim status through their preferred channel, it enhances transparency. They feel more in control of the process and have a better understanding of what’s happening with their claim. This transparency builds trust and customer confidence.

- Improved Customer Satisfaction: A more efficient and flexible claims process ultimately leads to higher customer satisfaction. When customers feel that their claims are being handled with care, in a manner that suits their needs, they are more likely to have a positive view of the insurance company and may remain loyal customers.

2. Personalized Policy Recommendations

Personalized Policy Recommendations” refer to the practice of tailoring insurance policy suggestions to meet the specific needs, preferences, and circumstances of individual customers. This is a pivotal aspect of providing an exceptional customer experience and is greatly facilitated by the implementation of an omnichannel communication strategy. Let’s break down this concept further:

- Understanding Unique Customer Needs: Each customer has unique insurance needs based on their life situation, risk tolerance, financial status, and personal preferences. What might be an ideal insurance policy for one customer may not suit another. Insurers must thoroughly understand these distinctions to provide the best possible coverage.

- The Role of Omnichannel Strategies: Omnichannel communication strategies encompass engaging with customers through various channels, such as phone, email, chat, text messages, and social media. These channels serve as valuable touchpoints to collect information about a customer’s requirements and preferences. This data can include details about their family, financial situation, property, health, and more.

- Tailored Policy Recommendations: Armed with the information gathered through omnichannel interactions, insurance companies can offer personalized policy recommendations. For instance, if a customer has a young family, their policy recommendation might include life insurance, while a customer with a high-value property might receive a recommendation for comprehensive homeowners’ insurance. In essence, it’s about presenting insurance options that align with the customer’s unique situation.

- Considering Individual Preferences and Circumstances: A key aspect of personalized policy recommendations is taking into account individual preferences and circumstances. This means understanding how much coverage a customer desires, what they can afford, and the level of risk they are comfortable with. For instance, some customers may prefer lower premiums with higher deductibles, while others may prioritize comprehensive coverage with slightly higher premiums.

The Benefits: When insurers offer personalized policy recommendations, several benefits arise:

- Enhanced Customer Satisfaction: Customers appreciate that their insurer is not providing a one-size-fits-all solution. They feel valued when their unique needs are taken into consideration, leading to greater satisfaction.

- Increased Trust: Tailored recommendations demonstrate a deep understanding of the customer’s situation and build trust. When customers perceive that their insurer has their best interests at heart, they are more likely to stay loyal.

- Improved Risk Management: For insurance companies, offering policies that are aligned with customer needs reduces the likelihood of claims disputes and non-renewals. This, in turn, contributes to more stable and profitable operations.

- Higher Customer Retention: Customers who receive policies tailored to their needs are more likely to renew their policies. This leads to improved customer retention rates and long-term profitability for insurers.

An omnichannel communication strategy enables insurers to collect the necessary data and engage with customers on a personal level, resulting in more satisfied, loyal customers and better risk management. It’s a win-win situation where customers get the coverage they truly need, and insurers build stronger, lasting relationships.

3. Immediate Assistance

Insurance is all about providing financial security and peace of mind to customers when unexpected events occur. Whether it’s a car accident, a medical emergency, property damage, or any other covered event, customers expect swift and efficient assistance from their insurance provider when they need it most.

The Importance of Quick Assistance:

- Emotional and Financial Impact: When a customer contacts their insurance company, it’s often during a time of distress or crisis. The situation might involve physical injuries, emotional stress, or financial loss. Quick assistance is not just a matter of convenience; it can significantly impact a customer’s well-being and recovery.

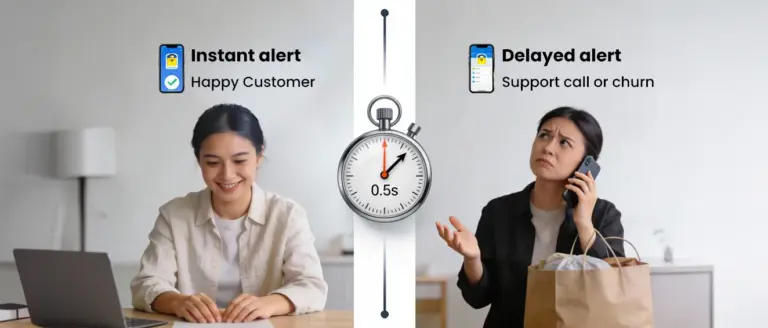

- Expectation of Responsiveness: In today’s digital age, customers have become accustomed to rapid responses in various aspects of their lives. They expect the same level of responsiveness from their insurance company. Delays in communication or claims processing can lead to frustration and dissatisfaction.

How Omnichannel Enables Immediate Support?

- Availability on Preferred Channels: Every customer has their preferred mode of communication. Some might favor text messages for quick questions, while others prefer phone calls for more detailed discussions. An omnichannel approach ensures that customers can reach out through the channel they are most comfortable with.

- Real-Time Interaction: Features like live chat and dedicated customer service hotlines in an omnichannel communication strategy enable customers to get in touch in real-time. This is especially vital during emergencies or when time-sensitive information is needed.

- Prompt Responses: With an omnichannel setup, insurers can prioritize immediate concerns. Whether it’s addressing a coverage question, explaining a policy term, or helping with a claim, the ability to respond promptly reassures customers and demonstrates a commitment to their well-being.

- Consistency and Continuity: Regardless of the communication channel chosen, the customer’s information and case history should be accessible to the support team. This ensures that customers don’t have to repeat themselves and that the support they receive is consistent and well-informed.

4. Consistency Across Channels

Consistency across channels entails ensuring that the customer’s experience remains uniform and reliable, regardless of which communication channel they choose to interact with the insurance company, whether it’s a traditional phone call or a modern social media platform. Let’s delve into this concept in more detail:

- Uniformity of Information and Messaging: In a consistent omnichannel approach, the information and messaging provided to the customer should be the same, irrespective of the communication channel they use. For instance, if a customer inquires about their policy coverage via social media and then follows up with a phone call, they should receive identical information. This consistency minimizes the risk of misinformation or confusion.

- Seamless Transition: The transition from one channel to another should be smooth. Customers often use multiple channels during their journey, so a consistent experience means they can easily switch from, say, a mobile app chat to a phone conversation without encountering disparities in the information or service quality. This seamless transition enhances the overall customer experience.

- Hyper-Personalization Continuity: An effective omnichannel communication strategy also ensures that hyper-personalization remains intact across channels. If a customer has provided specific information or preferences, such as their communication language or past interactions, these details should be accessible and applied consistently. This hyper-personalization fosters a sense of being known and valued by the insurance provider.

- Timely Responses and Resolution: Consistency extends to response times and issue resolution. Whether a customer contacts the insurer via email, social media, or phone, they should experience similar levels of responsiveness and timely issue resolution. This consistency instills confidence in the insurer’s ability to deliver on its promises.

- Customer Trust and Reliability: The key benefit of maintaining consistency across channels is the establishment of trust and reliability. When customers perceive that their insurance company provides a dependable and uniform experience, they are more likely to trust the information and service they receive. This trust is a fundamental driver of customer loyalty, which is of paramount importance in the insurance industry.

- Compliance and Regulatory Considerations: Consistency across channels also plays a role in regulatory compliance. In the insurance sector, there are often strict regulations governing how customer interactions must be handled and documented. Maintaining consistent processes and records across channels helps ensure compliance with these regulations.

It’s all about providing customers with a uniform, reliable, and seamless experience. This uniformity fosters trust, encourages customer satisfaction, and ultimately enhances the overall reputation and success of an insurance company. It reflects a commitment to meeting customer expectations, which, in today’s competitive market, is a strategic imperative for insurance providers.

The benefits of implementing an omnichannel communication strategy are substantial:

- Enhanced Customer Retention: By providing a seamless and consistent experience, insurers can build stronger, long-lasting relationships with their policyholders. Satisfied customers are more likely to renew their policies and continue their relationship with the insurance provider.

- Improved Customer Satisfaction: Meeting customers on their preferred communication channels results in increased satisfaction, ultimately translating into positive word-of-mouth referrals and higher customer lifetime value.

- Operational Efficiency: Streamlining communication through an omnichannel approach can lead to more efficient processes, reducing costs and minimizing errors.

- Data-Driven Insights: Omnichannel strategies also provide valuable data that can be used to understand customer behavior, preferences, and pain points. This data is a goldmine for insurers looking to refine their offerings and services based on customer insights.

In essence, the evolution of the insurance customer experience is a response to changing customer demands and expectations. Those insurance companies that prioritize seamless, consistent, and personalized communication are more likely to succeed in today’s competitive landscape. With the right strategy and technology, insurers can leverage the full potential of omnichannel communication to enhance customer satisfaction, loyalty, and, in turn, their own success in the industry.

Leveraging Omnichannel Communication Strategy for Success

When customers receive exceptional service and have a positive, personalized experience, they’re more likely to stay loyal to the insurer. Moreover, a well-executed omnichannel communication strategy provides valuable data insights. Insurers can use this data to better understand customer behavior, identify pain points, and make data-driven decisions that further refine their offerings and services.

Ultimately, the path forward in the insurance industry is clear: to thrive in a competitive landscape, insurers must recognize the evolving demands of their customers and adopt an omnichannel communication strategy to meet and exceed these expectations. This strategic shift can lead to enhanced customer satisfaction, increased loyalty, and, as a result, greater success for insurers in a rapidly changing marketplace.

Enhance Cross-Channel Communication in the Insurance Sector!

Banking

Banking

Insurance

Insurance

Credit Unions

Credit Unions

Professional Services

Professional Services

Consulting & Advisory

Consulting & Advisory

Legacy Migration

Legacy Migration

Insights

Insights

Whitepapers

Whitepapers

FAQs

FAQs

Brochures

Brochures

E-Books

E-Books

Glossary

Glossary

Case Studies

Case Studies

Events & News

Events & News

About Us

About Us

Information Security

Information Security

FCI Cares

FCI Cares

Leadership

Leadership

Careers

Careers

Partner Program

Partner Program

Current Openings

Current Openings