Attain Growth From First Party Banking Data

VARTA replaces siloed CCM and alert systems by transforming every customer touchpoint into a precise, profitable signal

Rise In Operational Efficiency

Reduction In Service Request Time

Reduction In Total Cost Of Ownership

Efficiency In Transactional

Processes

Driving Banking Growth: The VARTA Advantage

Compliance governed communications that turn regulatory discipline into measurable banking growth

Deposit

Growth

Anticipate customer intent by analyzing surplus liquidity and salary inflows to trigger contextual offers for FDs, savings sweeps, or investments; in the moment.

Lending

Growth

Move beyond static credit scores by using Behavioral Intelligence to detect real-time intent (spending shifts, life events) and instantly push the next-best, right-fit loan offer.

Card Spend

Acceleration

Drive wallet-share growth with contextual nudges delivered immediately following low-spend periods or category-specific transactions.

Third-Party

Products

Identify adjacent customer needs based on financial behavior to compliantly cross-sell partner products within transactional messages.

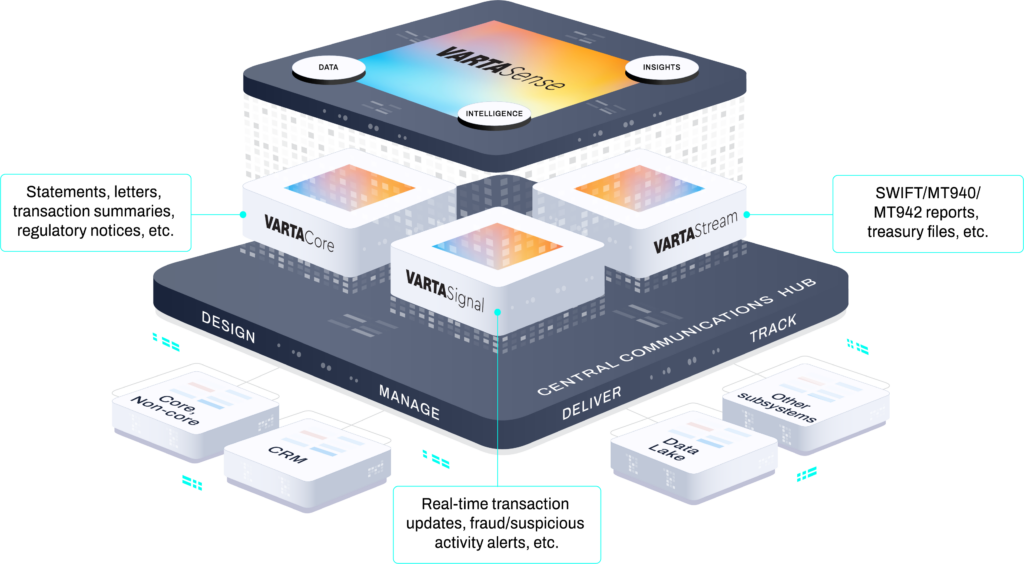

VARTA: Unified Intelligence For Decisive Action

Transform fragmented ecosystem into a single Central Communication Hub Eliminate data silos and convert real-time signals into orchestrated growth, compliance, and risk mitigation

Unify transactional, behavioral, and attitudinal data into a single source of truth. Align Product, Marketing, and Risk teams, ensuring every decision starts from a complete customer understanding.

Move beyond static segmentation. Use context- awareness to detect immediate shifts: a low balance, a life event, or a cash influx to anticipate the precise Next Best Action required.

Deliver adaptive, one-to-one journeys that evolve with the customer. Act on real-time intent and every touchpoint is delivered with hyper-relevance, driving higher conversion rates and lasting loyalty.

By centering data and action in one platform banks ensure profitable nudges, mandatory disclosures, and risk alerts are managed simultaneously.

Explore more

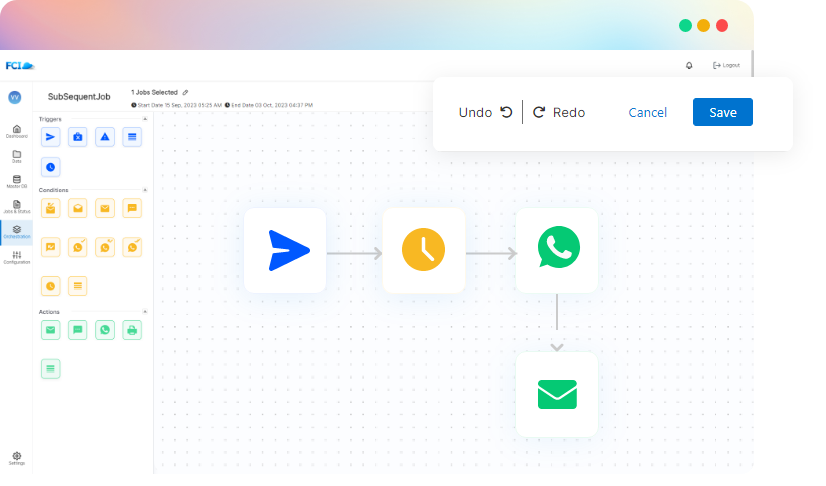

Bring Order To Every Communication Flow

Generate and deliver ISO 20022-compliant, multi-format statements in real time, giving treasurers immediate access to accurate data.

Guarantee time-critical messages reach the customer instantly. Maintain audit trails, enforce permissions, and keep operational risk in check.

Capture live transactional signals that reflect revenue risk, fraud events, payment behavior, and responsiveness. Build real-time awareness to act with confidence.

CASE STUDY

How India's Largest Private Sector Bank Projected A 3x Revenue Growth

FCI partnered with ICICI bank to transform its communication operations and boost customer satisfaction

Orchestrating Communications For Revenue, Risk, And Compliance

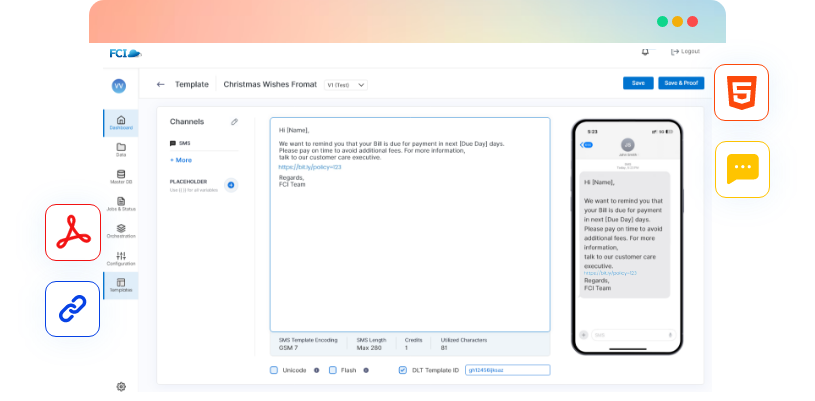

Ensure excellence across all critical banking functions by unifying control over the entire communication lifecycle

VARTACore

Documents, letters, and statements delivered through a unified, compliant framework.

Single governed communication and data layer.

Centralized templates, workflows, and compliance controls.

Consistent, scalable communication across all business units.

VARTASignal

Real-time transactional notifications, OTPs, and alerts that keep customers informed and engaged via SMS, email, WhatsApp, and push notifications.

Instant transaction and balance alerts.

Payment reminders and due-date nudges.

Prevent fraud with proactive event-based messaging.

VARTAStream

Intelligent, no-code communication flows for precise, high-speed business and commercial banking statement delivery.

Enriched EOD and intra-day statements.

Multi-format, ERP-compatible, ISO 20022-ready statements.

Automate omni-channel distribution without middleware, streamlining operations.

VARTASense

Real-time, AI-driven contextual and behavioral insights that guide every next-best action.

Understand customer intent before they express it.

Recommend product offers aligned to financial goals and life moments.

Power hyper-personalized journeys that increase conversion and loyalty.

VARTACore

Documents, letters, and statements delivered through a unified, compliant framework.

Single governed communication and data layer.

Centralized templates, workflows, and compliance controls.

Consistent, scalable communication across all business units.

VARTASignal

Real-time transactional notifications, OTPs, and alerts that keep customers informed and engaged via SMS, email, WhatsApp, and push notifications.

Instant transaction and balance alerts.

Payment reminders and due-date nudges.

Prevent fraud with proactive event-based

messaging.

VARTAStream

Intelligent, no-code communication flows for precise, high-speed business and commercial banking statement delivery.

Enriched EOD and intra-day statements.

Multi-format, ERP-compatible, ISO 20022-ready statements.

Automate omni-channel distribution without

middleware, streamlining operations.

VARTASense

Real-time, AI-driven contextual and behavioral insights that guide every next-best action.

Understand customer intent before they express it.

Recommend product offers aligned to financial

goals and life moments.

Power hyper-personalized journeys that

increase conversion and loyalty.

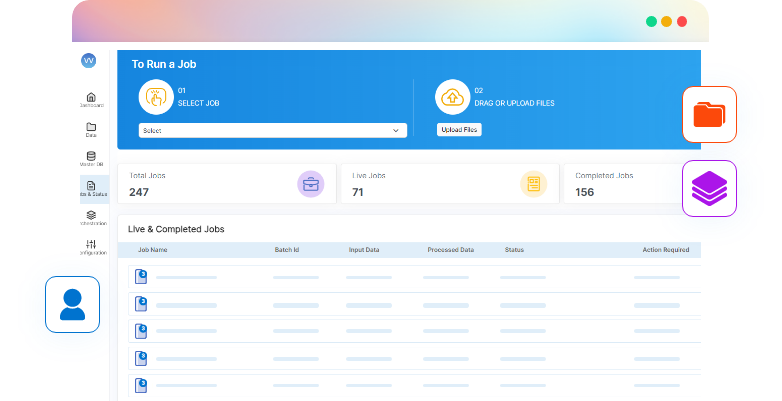

VARTA Solution Suite

Shape Better Customer Journeys With One Integrated, Outcome-Focused Engagement Layer

Wondering how it’ll work for you?

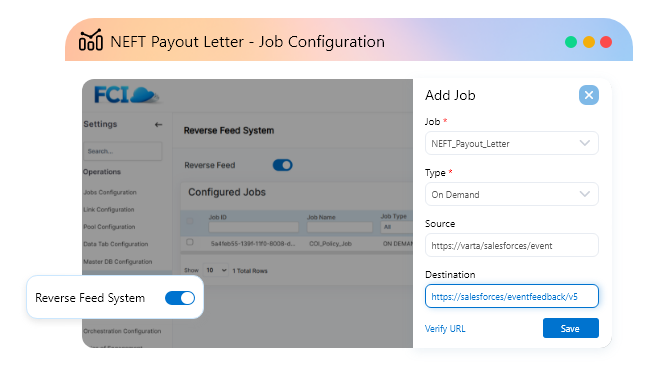

VARTA Seamlessly Works With Your Existing Stack

Maximize the value of your tech investments by capturing signals and automating action

Core Banking Systems

VARTA integrates directly with your CBS to capture real-time transactional signals—so you can act instantly on deposits, loans, and payments.

Explore more

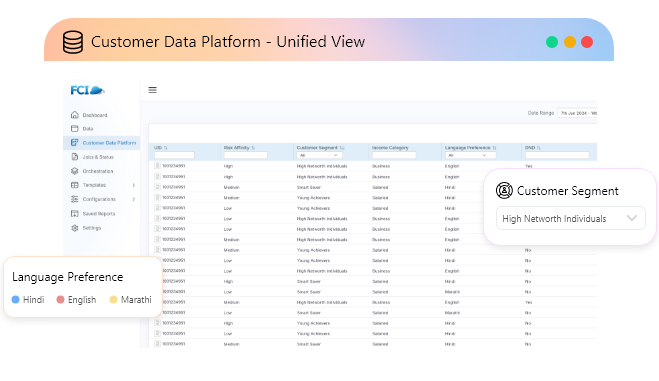

Customer Data Platform

Experience versatile interactivity with Varta’s command centre that streamlines communication of the customer according to the preferred channel.

Explore more

Customer Relationship Management

Supercharge your CRM with actionable intelligence. VARTA prioritizes leads, recommends next-best actions, and empowers RMs to engage at the right moment.

Explore more

Unified Engagement Layer

VARTA unifies fragmented stacks into a single engagement layer bridging:

- MarTech

- CPaaS

- CCM and compliance tools

Explore more

VARTA Seamlessly Works With Your Existing Stack

Maximize the value of your tech investments by capturing signals and automating actions.

Core Banking Systems

VARTA integrates directly with your CBS to capture real-time transactional signals—so you can act instantly on deposits, loans, and payments.

Explore more

- Solution brief: VARTA Extends the Power of Core Banking Systems

Customer Data Platform

Experience versatile interactivity with Varta’s command centre that streamlines communication of the customer according to the preferred channel.

Explore more

- Why CDPs Alone Can’t Drive Banking Growth

Customer Relationship Management

Supercharge your CRM with actionable intelligence. VARTA prioritizes leads, recommends next-best actions, and empowers RMs to engage at the right moment.

Explore more

- Boosting RM Productivity with VARTA + CRM

Unified Engagement Layer

VARTA unifies fragmented stacks into a single engagement layer—bridging martech, CPaaS, CCM, and compliance tools.

Explore more

- Simplify Your Stack: Why Banks Don’t Need 4 Different Platforms to Drive Growth

Don't Just Take Our Word For It

Banking

Banking

Insurance

Insurance

Credit Unions

Credit Unions

Professional Services

Professional Services

Consulting & Advisory

Consulting & Advisory

Legacy Migration

Legacy Migration

Insights

Insights

Whitepapers

Whitepapers

FAQs

FAQs

Brochures

Brochures

E-Books

E-Books

Glossary

Glossary

Case Studies

Case Studies

Events & News

Events & News

About Us

About Us

Information Security

Information Security

FCI Cares

FCI Cares

Leadership

Leadership

Careers

Careers

Partner Program

Partner Program

Current Openings

Current Openings The True 360° Customer View

The True 360° Customer View Decode Real-Time Intent

Decode Real-Time Intent Scale Hyper-Personalization

Scale Hyper-Personalization The Unified Growth Engine

The Unified Growth Engine