Turn Policyholder Communications into Loyalty, LTV, and Renewal Superpower

Connect your data, templates, and channels across the enterprise for unmatched speed, total compliance, and measurable growth.

Rise In Operational Efficiency

Reduction In Service Request Time

Reduction In Total Cost Of Ownership

Efficiency In Transactional

Processes

Driving Insurance Growth: The VARTA Advantage

VARTA’s intelligent execution layer transforms risk data and policyholder behaviors into profitable growth outcomes across the enterprise

Renewal & Retention Growth

Anticipates policyholder intent by analyzing behavioral signals (e.g., payment methods, policy utilization) to trigger contextual retention offers or personalized payment plans to prevent lapse risk.

Upsell & Cross-Sell Acceleration

Goes beyond static risk profiles by using Behavioral Intelligence to detect real-time life events or coverage gaps and instantly push the next-best, right-fit supplemental offer (e.g., a rider or high-value asset cover).

Claims Journey

as a Growth

Driver

Drives post-claim loyalty and LTV with nudges delivered immediately following a successful payout, recommending related or upgraded coverages.

Policy Modification

& Add-Ons

Identifies adjacent coverage needs based on policy activity (e.g., home/auto upgrades, new dependents) to compliantly cross-sell tailored riders and modifications within transactional communications.

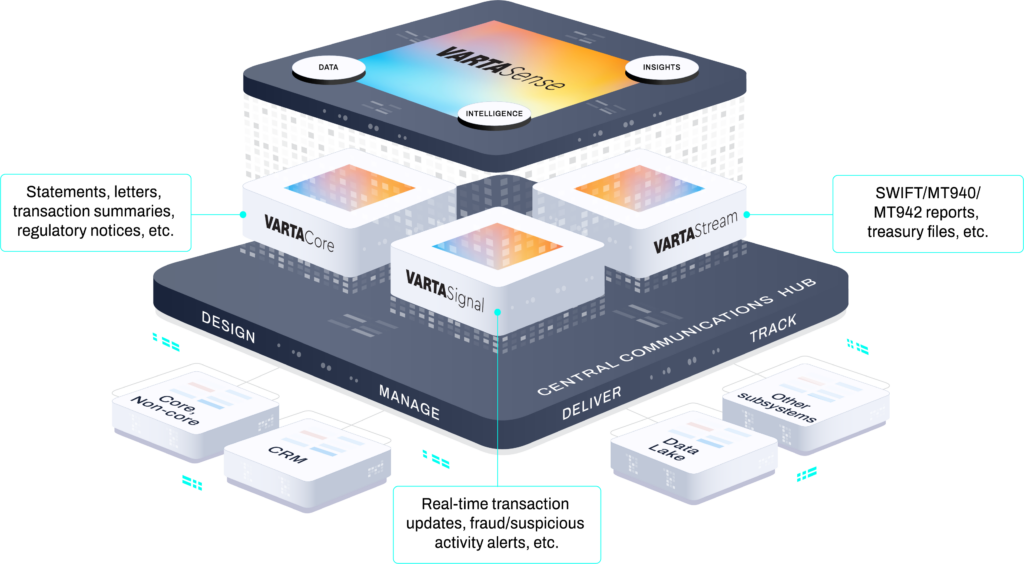

The VARTA Engine: Orchestrating Policyholder Lifetime Value

Transform siloed claims, policy, and behavioural data into unified, real-time policyholder engagement. Replace legacy systems with a central communication hub built to manage profitable growth, compliance, and claims excellence simultaneously

Merge claims history, policy details, payment patterns, and behavioral data into a single source of truth. This aligns Underwriting, Claims, and Service teams, ensuring every decision is based on a complete, 360° policyholder understanding.

Move beyond fixed renewal cycles. Detect immediate risk signals—like payment failure, low engagement, or life events—using Context-Aware Nudging and instantly deploy a personalized retention offer or payment solution.

Every claim is an LTV moment. Automate and personalize claims status updates, documentation requests, and follow-up offers using real-time data. This delivers hyper-relevant service that converts a crisis moment into lasting loyalty.

By centering data and action in one platform, ensure mandatory disclosures, payment alerts, and compliant claims documents are managed simultaneously, maintaining a full audit trail for every single policyholder touchpoint.

Explore more

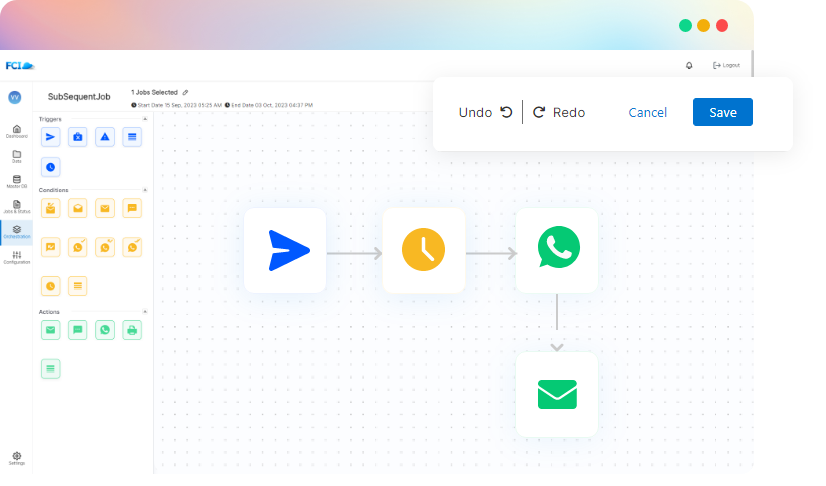

Communication Orchestration That Protects Policy Value

Claims, premium, and behavioral data decoded within regulatory boundaries to create compliant, non-intrusive insights that strengthen renewal timing and coverage recommendations.

Time-critical messages like FNOL, fraud warnings, premium failures, and OTPs delivered instantly across consent-approved channels with full audit visibility.

Transactional and channel behavior interpreted live to remove operational bottlenecks, enforce compliance, and make personalization possible at scale.

CASE STUDY

FCI Transformed Aegon Life Insurance’s CX with Cutting-Edge Technology

See how Aegon Life achieved 70%+ lift in open and click rates by transforming customer communication for better trust, adoption and real-time feedback

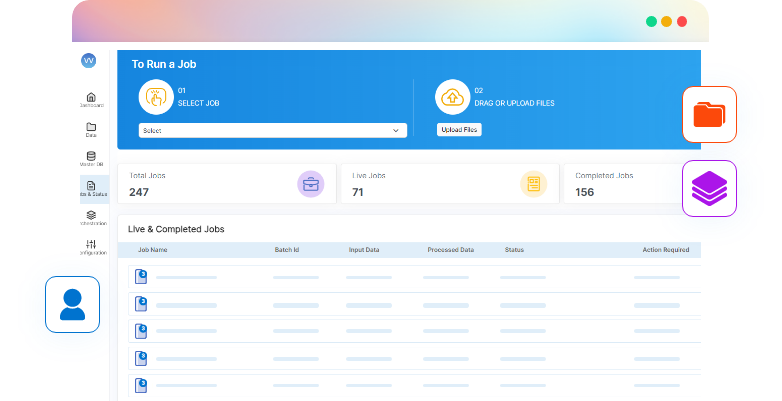

The Unified Platform for Contextual Policyholder Engagement

Ensure excellence across all critical insurance functions by unifying control over the entire communication lifecycle.

VARTACore

Documents, letters, and statements delivered through a unified, compliant framework.

Single governed communication and data layer.

Centralized templates, workflows, and compliance controls.

Consistent, scalable communication across all business units.

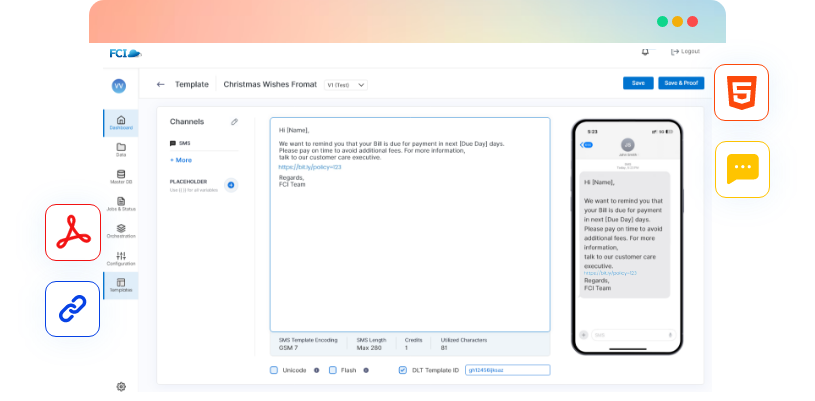

VARTASignal

Real-time transactional notifications, OTPs, and alerts that keep customers informed and engaged via SMS, email, WhatsApp, and push notifications.

Instant transaction and balance alerts.

Payment reminders and due-date nudges.

Prevent fraud with proactive event-based messaging.

VARTAStream

Intelligent, no-code communication flows for precise, high-speed business and commercial banking statement delivery.

Enriched EOD and intra-day statements.

Multi-format, ERP-compatible, ISO 20022-ready statements.

Automate omni-channel distribution without middleware, streamlining operations.

VARTASense

Real-time, AI-driven contextual and behavioral insights that guide every next-best action.

Understand customer intent before they express it.

Recommend product offers aligned to financial goals and life moments.

Power hyper-personalized journeys that increase conversion and loyalty.

VARTACore

Documents, letters, and statements delivered through a unified, compliant framework.

Single governed communication and data layer.

Centralized templates, workflows, and compliance controls.

Consistent, scalable communication across all business units.

VARTASignal

Real-time transactional notifications, OTPs, and alerts that keep customers informed and engaged via SMS, email, WhatsApp, and push notifications.

Instant transaction and balance alerts.

Payment reminders and due-date nudges.

Prevent fraud with proactive event-based

messaging.

VARTAStream

Intelligent, no-code communication flows for precise, high-speed business and commercial banking statement delivery.

Enriched EOD and intra-day statements.

Multi-format, ERP-compatible, ISO 20022-ready statements.

Automate omni-channel distribution without

middleware, streamlining operations.

VARTASense

Real-time, AI-driven contextual and behavioral insights that guide every next-best action.

Understand customer intent before they express it.

Recommend product offers aligned to financial

goals and life moments.

Power hyper-personalized journeys that

increase conversion and loyalty.

VARTA Solution Suite

Shape Better Customer Journeys With One Integrated, Outcome-Focused Engagement Layer

Wondering how it’ll work for you?

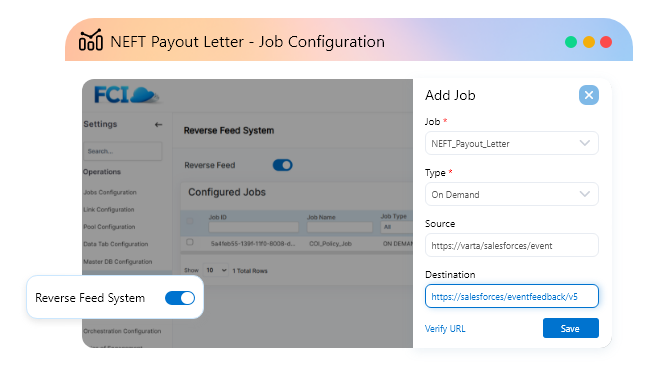

VARTA Seamlessly Works With Your Existing Stack

Maximize the value of your tech investments by capturing signals and automating action

Core Banking Systems

VARTA integrates directly with your CBS to capture real-time transactional signals—so you can act instantly on deposits, loans, and payments.

Explore more

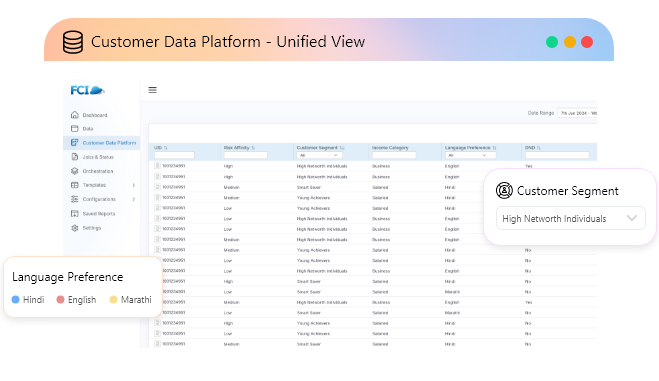

Customer Data Platform

Experience versatile interactivity with Varta’s command centre that streamlines communication of the customer according to the preferred channel.

Explore more

Customer Relationship Management

Supercharge your CRM with actionable intelligence. VARTA prioritizes leads, recommends next-best actions, and empowers RMs to engage at the right moment.

Explore more

Unified Engagement Layer

VARTA unifies fragmented stacks into a single engagement layer bridging:

- MarTech

- CPaaS

- CCM and compliance tools

Explore more

VARTA Seamlessly Works With Your Existing Stack

Maximize the value of your tech investments by capturing signals and automating actions.

Core Banking Systems

VARTA integrates directly with your CBS to capture real-time transactional signals—so you can act instantly on deposits, loans, and payments.

Explore more

- Solution brief: VARTA Extends the Power of Core Banking Systems

Customer Data Platform

Experience versatile interactivity with Varta’s command centre that streamlines communication of the customer according to the preferred channel.

Explore more

- Why CDPs Alone Can’t Drive Banking Growth

Customer Relationship Management

Supercharge your CRM with actionable intelligence. VARTA prioritizes leads, recommends next-best actions, and empowers RMs to engage at the right moment.

Explore more

- Boosting RM Productivity with VARTA + CRM

Unified Engagement Layer

VARTA unifies fragmented stacks into a single engagement layer—bridging martech, CPaaS, CCM, and compliance tools.

Explore more

- Simplify Your Stack: Why Banks Don’t Need 4 Different Platforms to Drive Growth

Don't Just Take Our Word For It

Banking

Banking

Insurance

Insurance

Credit Unions

Credit Unions

Professional Services

Professional Services

Consulting & Advisory

Consulting & Advisory

Legacy Migration

Legacy Migration

Insights

Insights

Whitepapers

Whitepapers

FAQs

FAQs

Brochures

Brochures

E-Books

E-Books

Glossary

Glossary

Case Studies

Case Studies

Events & News

Events & News

About Us

About Us

Information Security

Information Security

FCI Cares

FCI Cares

Leadership

Leadership

Careers

Careers

Partner Program

Partner Program

Current Openings

Current Openings Merge for a Unified Policyholder View

Merge for a Unified Policyholder View Preempt Renewal & Lapse Risk

Preempt Renewal & Lapse Risk Scale the Claims Experience

Scale the Claims Experience Unify compliance and engagement engine

Unify compliance and engagement engine