Why Personalized Account Statements Matter in Modern Banking

The Shift from Generic to Personalized Communication

In the past, Banks used to send the same type of account statements to every customer—basic documents showing transactions, balances, and maybe some generic messages or offers. But today, we’re in a digital-first environment where customers expect more. They don’t just want a list of numbers—they want information that’s relevant to their life and financial goals.

For example:

- A customer might want a quick summary of their monthly spending habits.

- Another might appreciate a reminder that they’re close to reaching their savings goal.

- Others may find it helpful to get personalized financial tips or offers based on how they bank.

So instead of just telling customers what happened in their account, personalized statements show them what it means and what they can do next, whether that’s saving more, spending smarter, or exploring a service that fits their needs.

This is where Personalization shines.

According to a 2021 report by Accenture, 91% of consumers are more likely to buy from brands that offer relevant suggestions and offers. That behavior extends into banking—people want their banks to understand them and communicate accordingly.

For financial institutions, this personalization shift means more than just happy customers. It helps:

- Improve engagement and trust

- Reduce service calls (since information is clearer)

- Increase product adoption and cross-selling

- Lower operational costs through smarter automation

The Intelligent CCM Engine Behind Personalization

Meet “VARTA”

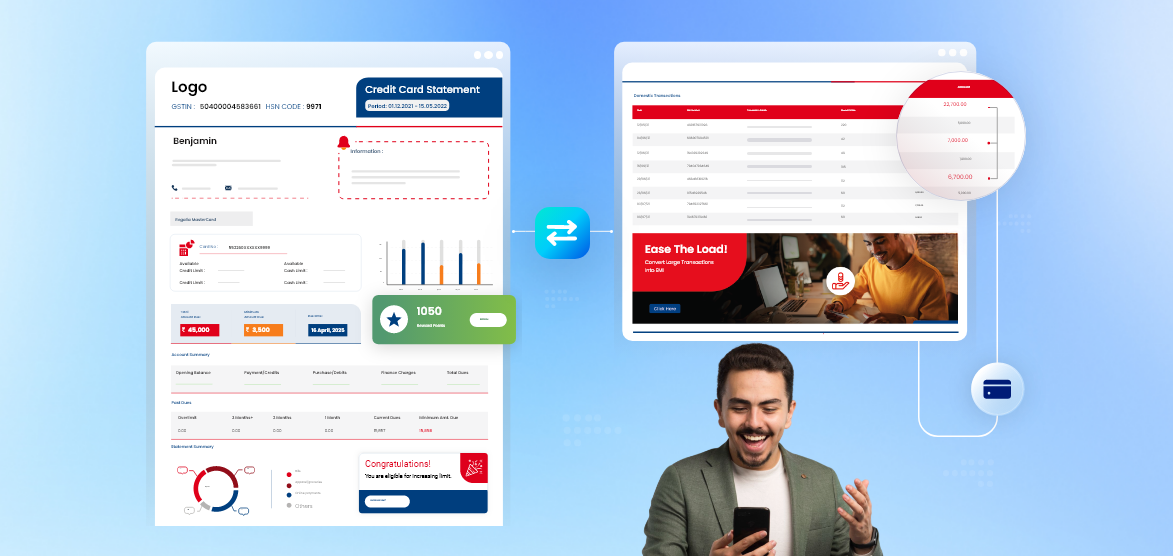

VARTA is an advanced Intelligent Customer Communication Management (CCM) platform built specifically for banks and financial institutions. It empowers organizations to automate, personalize, and streamline customer communications—turning every message or statement into a meaningful, relevant interaction.

Instead of sending the same generic statement to every customer, VARTA allows financial institutions to deliver dynamic and personalized content that reflects each customer’s individual preferences, behaviors, and financial needs. This helps banks deepen customer relationships while improving communication efficiency and engagement.

VARTA Key Capabilities

1. Dynamic Data Mapping

VARTA connects with multiple internal systems—like CRMs, core banking platforms, and analytics tools—to pull real-time customer data. This data is then used to tailor each communication with personalized insights, messages, and offers. For example:

- Pulling a customer’s recent transactions to display personalized spending insights

- Using location or demographic data to suggest local branch services or offers

2. Omnichannel Output

Not all customers prefer the same channel. VARTA ensures that personalized statements can be delivered across multiple formats, including Emails, SMS, Push Notifications, WhatsApp, etc.

This ensures that every customer receives their statement where they’re most likely to engage with it.

3. Built-in Personalization Engine

At the heart of VARTA is a powerful personalization engine. It automatically adapts:

- Layouts (e.g., highlighting different sections depending on the customer type)

- Offers (e.g., showing a pre-approved loan offer for an eligible customer)

- Messages (e.g., goal tracking for savers, investment tips for high-net-worth individuals)

This allows each customer statement to feel as if it were tailor-made, increasing relevance, boosting satisfaction, and opening doors for upselling or cross-selling opportunities.

How Personalized Account Statements Work with VARTA

VARTA uses intelligent automation and customer data insights to transform standard bank statements into context-aware, value-driven communications. Here’s how it works under the hood:

A Step-by-Step Personalization Flow:

1. Data Aggregation

VARTA connects with your core banking systems, CRMs, and other enterprise platforms to gather rich customer data in real-time. This includes:

- Transaction history

- Product holdings (savings, credit, investments)

- Customer demographics

- Channel preferences

- Past interactions

Example: If a customer has a mortgage and an investment account, VARTA captures this along with relevant activity to tailor the content accordingly.

2. Profile Segmentation

VARTA uses AI and business logic to group customers into dynamic segments based on:

- Spending behavior (e.g., frequent traveler, online shopper)

- Financial goals (e.g., saving for a home)

- Life stage (e.g., young professional, retiree)

- Engagement level (e.g., digitally active vs. branch-dependent)

This segmentation allows for targeted content that aligns with what matters most to each customer.

Example: A digitally-savvy customer might receive app usage tips, while a high-net-worth client gets premium investment insights.

3. Dynamic Template Generation

Once segmented, VARTA applies customized templates to build each statement on the fly:

- Visual layouts adapt to highlight what’s most relevant

- Messaging changes based on customer profile

- Promotions and tips are inserted using predefined rules and AI-driven logic

This eliminates the “one-size-fits-all” format and brings in true personalization at scale.

Example: A savings-focused customer might see charts tracking their monthly progress, while a credit card user gets a snapshot of reward points.

4. Channel Optimization

VARTA ensures that each statement reaches the customer through their preferred channel:

- Email or secure PDF attachments

- SMS notifications with statement highlights

- In-app or web portal viewing

- Print mail

This omnichannel approach improves open rates and user engagement.

Example: A customer who always uses the mobile banking app will receive a mobile-optimized, interactive statement with tap-to-explore insights.

Bank Personalization Examples in Action

Here’s how VARTA personalizes content to drive relevance and engagement:

Transaction Insights

“You spent 20% more on groceries this month — consider our cashback card.”

This flags spending patterns and provides timely financial advice or product suggestions. It demonstrates proactive service, not just reactive reporting.

Goal Tracking

“You’re 80% towards your savings goal. Let us help you get there faster.”

By linking account activity to personal goals, VARTA motivates continued engagement and builds trust. This also opens doors to upsell opportunities like higher-interest savings accounts or financial planning services.

Relevant Offers

“Special loan rates for loyal customers like you—check your pre-approved amount.”

Using loyalty metrics and eligibility criteria, VARTA tailors offers that feel exclusive and valuable, encouraging conversion without sounding generic or salesy.

Real-World Use Cases in Personalized Banking

1. Boosting Credit Card Usage

A mid-size retail bank leveraged VARTA to transform its static e-statements into dynamic and personalized PDFs. By analyzing each customer’s spending behavior and profile, VARTA inserted tailored credit card offers directly into the monthly account summaries. These offers aligned with individual preferences, like travel rewards for frequent flyers or cashback for high-volume spenders.

Outcome: This hyper-targeted approach led to a 12% increase in credit card activations within just three months, as customers were more likely to respond to offers relevant to their lifestyles and needs.

2. Reducing Call Center Volume

A top-tier national bank faced high volumes of calls related to account statements, ranging from confusion about charges to clarification requests. Using VARTA, the bank enriched its statements with contextual help text, tooltips, and inline explanations for complex transactions.

For example, instead of listing a vague transaction description like “POS 9043 XYZ,” the statement would clarify: “Grocery store purchase at XYZ Mart, downtown branch, $94.30.” It also added links to FAQs and support for self-resolution.

Outcome: These enhancements led to a 22% reduction in statement-related inquiries, freeing up customer support teams to focus on higher-value interactions.

3. Driving Cross-Sell Conversions

A wealth management division within a financial institution used VARTA to embed personalized investment insights and portfolio suggestions into customer communications. For example, clients with excess idle funds were shown relevant money market or fixed-income options, while others received personalized retirement planning nudges.

By positioning these suggestions inside monthly summaries, VARTA ensured they were seen during regular account check-ins, when users were already thinking about their finances.

Outcome: This led to a 15% uplift in service upgrades, including increased sign-ups for advisory services and premium investment products.

Industry Stats Supporting Personalized Communication

1. 80% of consumers are more likely to do business with a company if it offers personalized experiences.

Source: Epsilon

The majority of consumers expect brands, including banks, to understand their preferences and provide tailored solutions. This stat shows that personalization isn’t just a nice-to-have; it’s a key driver of customer acquisition and retention. When banks personalize statements or product recommendations, they increase the likelihood of repeat business and long-term loyalty.

2. 72% of Customers Rate Personalization as “Highly Important”.

Source: Businesswire

A study found that 72% of financial services customers consider personalization a top priority when interacting with banks or financial institutions. This means most customers expect tailored content, services, and communication, making personalization a critical factor for improving customer satisfaction and loyalty in today’s competitive landscape.

3. Personalization Can Drive Up to 15% Revenue Growth.

Source: McKinsey & Company

Personalization can lead to a revenue increase of up to 15% for companies in the financial services sector, as supported by McKinsey & Company’s research. Their findings indicate that effective personalization strategies can result in a 5% to 15% uplift in revenue, depending on the sector and the organization’s ability to execute these strategies. This revenue growth is attributed to enhanced customer experiences and increased engagement, which are outcomes of well-implemented personalization efforts.

These stats collectively highlight the critical importance of personalization in banking communication, not just as a CX enhancement, but as a strategic business growth driver. VARTA is designed to help financial institutions unlock this potential efficiently and at scale.

Conclusion: Elevate Every Statement into a Strategic Touchpoint

Account statements shouldn’t just be transactional—they should be used as engagement opportunities. Instead of simply listing account activity, each statement can deliver insights, personalized offers, and helpful nudges that drive customer interaction and loyalty. In other words, every monthly statement becomes a mini marketing and retention tool.

Personalized account statements powered by VARTA turn routine banking documents into value-rich, engaging experiences. VARTA transforms boring, generic statements into customized, dynamic documents that are relevant to each customer. This adds value beyond just showing balances or transactions. It increases customer loyalty and brand perception.

For financial institutions looking to enhance satisfaction, deepen relationships, and unlock new revenue streams, personalized communication is no longer optional—it’s essential.

Ready to Personalize Your Customer Communications? Get a Demo of VARTA Today…

Banking

Banking

Insurance

Insurance

Credit Unions

Credit Unions

Professional Services

Professional Services

Consulting & Advisory

Consulting & Advisory

Legacy Migration

Legacy Migration

Insights

Insights

Whitepapers

Whitepapers

FAQs

FAQs

Brochures

Brochures

E-Books

E-Books

Glossary

Glossary

Case Studies

Case Studies

Events & News

Events & News

About Us

About Us

Information Security

Information Security

FCI Cares

FCI Cares

Leadership

Leadership

Careers

Careers

Partner Program

Partner Program

Current Openings

Current Openings